Surety Bonds - Houston Texas

What is a Surety Bond and who needs one?

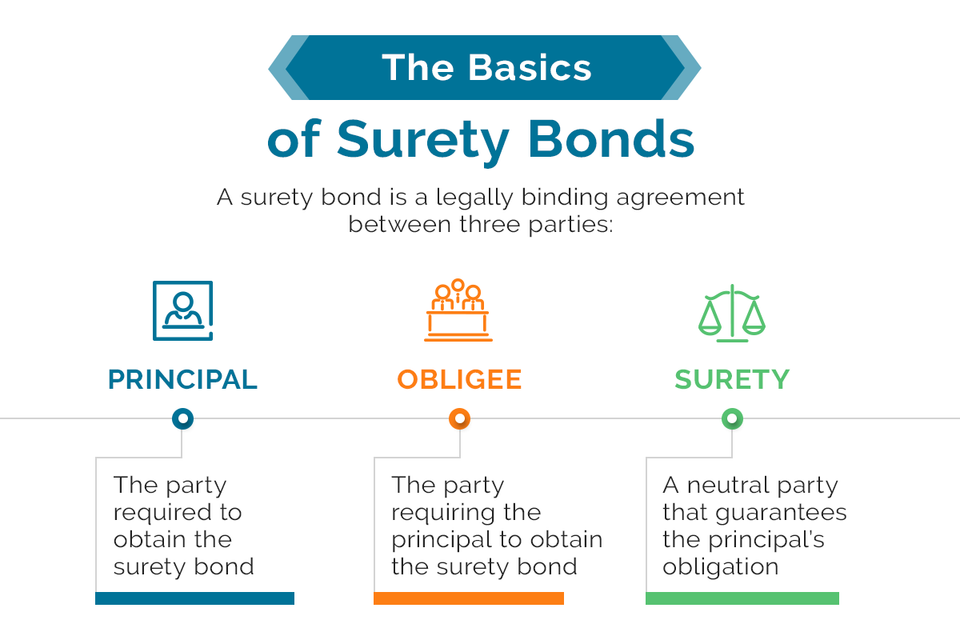

It is essential to understand that a surety bond involves three distinct parties.

The first party, known as the 'surety', is responsible for underwriting the bond. The second party, known as the 'obligee', is typically an individual or municipality that has entered into an agreement for a construction project and seeks financial protection if the project is not completed according to the specified terms. Finally, the contractor, also called the 'principal,' is the third party involved.

To summarize, a surety bond is a mutually binding agreement between the contractor (or principal), the surety (the bond underwriter), and the obligee (the project owner or municipality).

For those in charge of construction projects or municipalities, a surety bond acts as a safety net against contractors defaulting on their work. If the contractor does not meet the contract terms or complete the project, the bond's underwriter (Surety) will reimburse the owner, who can then seek reimbursement from the contractor.

Unlike standard insurance policies, surety bonds do not anticipate any losses. The surety prequalifies the principal to ensure they can fulfill their contractual obligations, with the bonded principal carrying the economic risk.

At Pan American Agency, we have a wealth of experience in providing surety bonds. We will help you obtain a surety bond for your construction project, ensuring a smooth process from start to finish.

It is essential to understand that a surety bond involves three distinct parties.

The first party, known as the 'surety', is responsible for underwriting the bond. The second party, known as the 'obligee', is typically an individual or municipality that has entered into an agreement for a construction project and seeks financial protection if the project is not completed according to the specified terms. Finally, the contractor, also called the 'principal,' is the third party involved.

To summarize, a surety bond is a mutually binding agreement between the contractor (or principal), the surety (the bond underwriter), and the obligee (the project owner or municipality).

For those in charge of construction projects or municipalities, a surety bond acts as a safety net against contractors defaulting on their work. If the contractor does not meet the contract terms or complete the project, the bond's underwriter (Surety) will reimburse the owner, who can then seek reimbursement from the contractor.

Unlike standard insurance policies, surety bonds do not anticipate any losses. The surety prequalifies the principal to ensure they can fulfill their contractual obligations, with the bonded principal carrying the economic risk.

At Pan American Agency, we have a wealth of experience in providing surety bonds. We will help you obtain a surety bond for your construction project, ensuring a smooth process from start to finish.

Automotive Insurance

At Pan American Agency, we offer assistance in getting insurance coverage for any vehicle, whether a modern Ferrari or an older Ford.

In Texas, all vehicles must have at least liability insurance coverage. This type of insurance covers medical and legal expenses in case you are held responsible for an accident that results in injury or property damage to another person.

In Houston, the minimum liability coverage required is:

• $30,000 for bodily injury liability per person

• $60,000 for bodily injury liability per accident

• $25,000 for property damage liability

If you are leasing or financing your vehicle, your lender may require additional coverage, such as collision and comprehensive coverage.

Uninsured/Underinsured motorist coverage is another popular option in Texas, which provides financial protection in case of an accident with an uninsured motorist.

If you plan to visit Mexico by car soon, ask us about adding Mexico Insurance for peace of mind. Mexican auto insurance provides vehicle insurance for tourists driving in Mexico.

We also insure:

• Classic Cars

• Boats, RV's, ATV's & Trailers

• Motorcycles and Scooters

In Texas, all vehicles must have at least liability insurance coverage. This type of insurance covers medical and legal expenses in case you are held responsible for an accident that results in injury or property damage to another person.

In Houston, the minimum liability coverage required is:

• $30,000 for bodily injury liability per person

• $60,000 for bodily injury liability per accident

• $25,000 for property damage liability

If you are leasing or financing your vehicle, your lender may require additional coverage, such as collision and comprehensive coverage.

Uninsured/Underinsured motorist coverage is another popular option in Texas, which provides financial protection in case of an accident with an uninsured motorist.

If you plan to visit Mexico by car soon, ask us about adding Mexico Insurance for peace of mind. Mexican auto insurance provides vehicle insurance for tourists driving in Mexico.

We also insure:

• Classic Cars

• Boats, RV's, ATV's & Trailers

• Motorcycles and Scooters

Homeowners Insurance

Safeguard your loved ones and home from unexpected events with our Homeowner's Insurance coverage.

Our coverage options are tailored to your specific requirements. We will work closely with you to find the most suitable fit.

Your homeowner's policy may include a range of key coverages, such as Personal Property, Dwelling, Other Structures, Additional Living Expenses, Medical Payment coverage, and Personal Liability.

With over 30 years of experience, Carmen and her experts are equipped to help you find the best coverage for your needs, at a great value.

At Pan American Agency, we specialize in a variety of insurance types including:

• Homeowners Insurance

• Renters Insurance

• Flood Insurance

• Condo, mobile home policies, and more!

If you don't see what you need, refer to our comprehensive list below or contact us today. We are eager to discuss your options and find the most suitable policy for your needs at the best value.

Our coverage options are tailored to your specific requirements. We will work closely with you to find the most suitable fit.

Your homeowner's policy may include a range of key coverages, such as Personal Property, Dwelling, Other Structures, Additional Living Expenses, Medical Payment coverage, and Personal Liability.

With over 30 years of experience, Carmen and her experts are equipped to help you find the best coverage for your needs, at a great value.

At Pan American Agency, we specialize in a variety of insurance types including:

• Homeowners Insurance

• Renters Insurance

• Flood Insurance

• Condo, mobile home policies, and more!

If you don't see what you need, refer to our comprehensive list below or contact us today. We are eager to discuss your options and find the most suitable policy for your needs at the best value.

T

Take the first step towards securing a bright future with Pan American Agency

Check out your insurance policy options below. Each policy comes with excellent value and unbeatable local service

- Surety Bonds

- Commercial General Liability

- Commercial Trucking Ins.

- Commercial Property Ins.

- Business Owners Insurance

- Contractor's Insurance

- Builder's Risk Insurance

- Restaurant Insurance

- Cyber Liability Insurance

- Workers Comp Insurance

- Trucking Insurance

- Commercial Property

- Liquor Liability Insurance

- Special Event Insurance

- Homeowner's Insurance

- Mobile Home Insurance

- Flood Insurance

- Renters Insurance

- Short-Term Rental Ins.

- Condo Insurance

- Landlord Insurance

- Auto Insurance

- Classic Car Insurance

- Motorcycle Insurance

- Mexico Insurance

- Recreational Vehicle Ins.

- ATV Insurance

- SR22 Insurance

T

Pan American Insurance Agency - Houston, Texas

Lock in the Lowest Possible Premium Today.

Rates are Rising Fast. Act Now and Save Money.

Rates are Rising Fast. Act Now and Save Money.